MaxDecisions: US subprime consumers are seeking credit at a historic pace due to uncontrolled inflationary pressure – part 1

Credit Trend

Research Overview

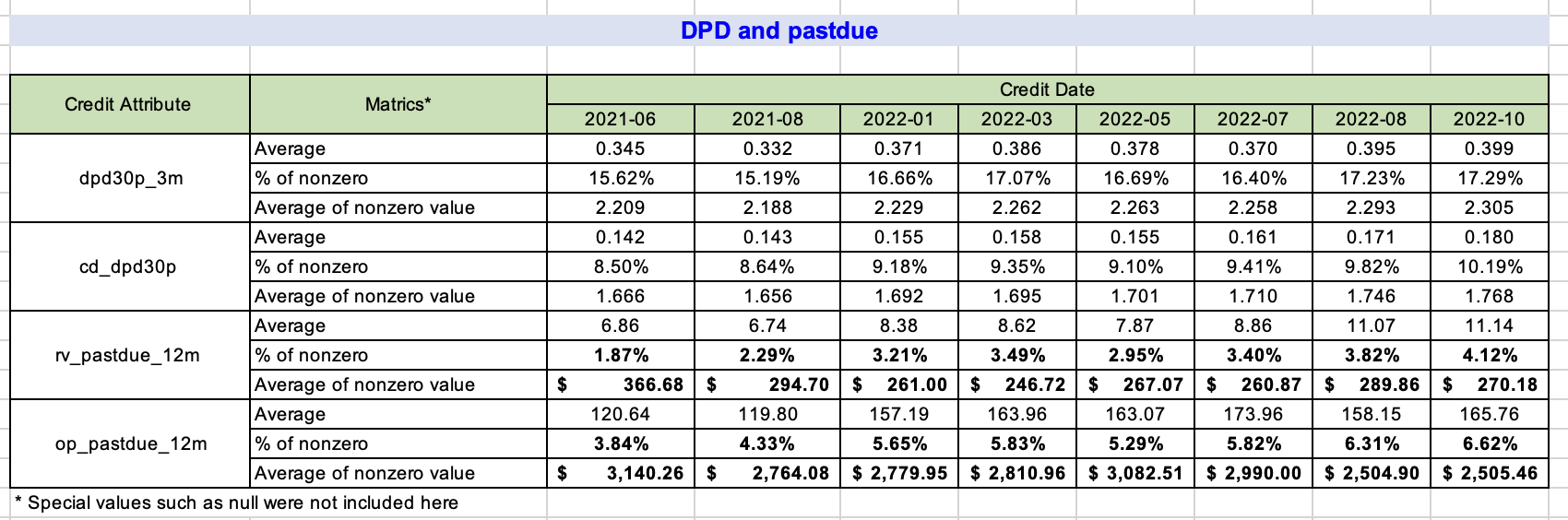

We’ve been tracking over 170 million US consumers across all credit spectrum from June 2021 to October 2022. From our first two research blogs, we observed a hastened growth in credit delinquency towards the end of 2022. We also observed that near prime, sub prime and deep subprime consumers are being impacted the most.

As we track 30 day delinquency, we saw 20% to 30% increase in delinquency for a large portion of the below prime population.

This is a worrisome trend for lenders and a potential wind fall for other companies in the consumer debt space. As inflationary pressure cooling slightly at the time of this blog. Consumer spending, unemployment rate are still at historic figures.

The talk of a recession has someone waned and the focus again is on the US Federal Reserves to set our borrowing interest rate even higher.

As lay off continues in the tech sectors, we will focus on consumer spending across these 18 months of observable period and test a few theories.

Term Definition:

We used June 2021 as our baseline and measured all subsequent months against our baseline. We picked 4 different measurements in terms of number of credit trades and inquiries to further explore any potential pressure in demand for credit in the face of ever mounting inflationary pressure.

Here are the four measurements we used in our research:

- Number of trades opened in the past 6 months – (td_6m)

- Number of revolving trades opened in the past 6 months – (rtd_6m)

- Number of deduped inquiries in the past 6 months (excluding auto and mortgage inquiries) – (inq_6m)

- Number of deduped bank inquiries in the past 3 months – (inq_b_3m)

Our research team at MaxDecisions picked these credit attributes believing that they reflect the most recent credit seeking behavior during post covid and 2022 inflationary period.

Our theory is that during this inflationary period, credit card companies are still offering credit despite rising interest rate. However, credit card companies have not adopted a different lending or underwriting strategy to consider our populations additional spending due to rising energy and food prices.

We believe that certain portion of our population seeking credit because of inflated consumer prices are most likely not getting additional credit because of this unchanged stance in underwriting from credit card issuers. The result could be catastrophic for this portion of the US consumer.

Inflation and Mass Layoffs

As of mid February 2023, inflation numbers are hovering around mid 6%. Even though it has fallen from its peak at9% during the middle of 2022, the velocity of decrease is not fast enough to warrant a decease in interest rate from the Feds. These numbers at 6%+ is also a far cry from the “2%” or lower target set by Feds.

Close to another 100,000 tech sector laid offs happened in just January 2023. And Feb 2023 is on pace for another 100,000 lay offs. Over 260 tech companies in January has some type of lay off, a year over year record.

Close to 300,000 tech lay offs in the past 14 months and counting just in the tech sector alone.

Numbers and Analysis

We sampled about 180 million US consumers over a year and a half from June 2021 to Oct 2022.

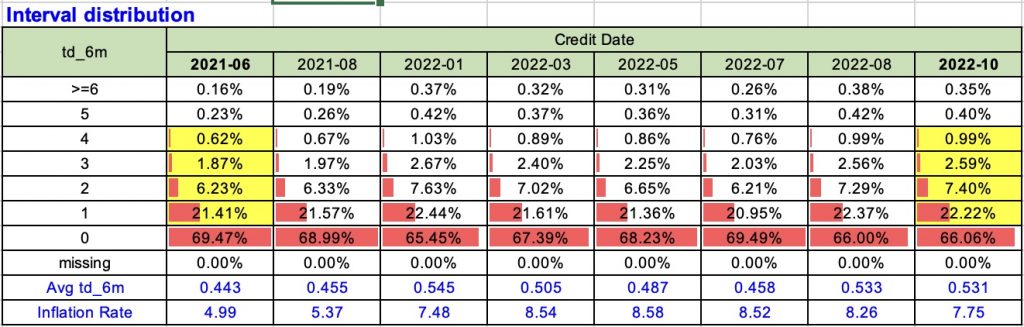

The first credit attribute we analyzed is “Number of trades opened in the past 6 months – (td_6m). The Y-axis of the table below represents number of trades (credit of any kind) opened in the past six months. The Y-Axis represents a time horizon from June 2021 to October 2022.

The number of people that didn’t open a new credit card or personal loan in the past 6 months went from 69.47% to 66.06%, a decrease of 4.9%. The number of people that opened one new trade line in the past six month went from 21.41% to 22.22%, a mere 3.78%, similar to those that didn’t or couldn’t open a new credit trade for one reason or another.

Now, let’s take a look at those that opened up 2, 3 or 4 credit trade line in the past 6 months.

For those that opened up 2 new credit trade lines. The percentage increase is more dramatic, from 6.23% to 7.40%, form June 2021 to October 2022, an increase of 18.78%!

For those that opened up 3 new credit trade line the increase is 38.5% from 1.87% to 2.59% of the 180 million US credit population. That’s about 1.29 million people got more than 3 new credit trades lines form June 2021 to October of 2022.

When it comes to 4 new trade lines, the increase is 51.38% from 0.62% to 0.99% of the US population. 600,000+ consumers got more than 4 credit trade lines opened in the past 6 months.

So why do we see this drastic difference in terms of new credit trade lines being opened between those that has no credit or low credit trades and those that had multiple new trades already?

We suspect that those with ability to open up more credit trade lines really geared up for more credit cards or personal installment loans. They are probably of higher credit grade than those who wanted new credit trade lines but couldn’t get them.

To test our theory, we stratified this dataset across credit band to see if indeed sub prime customers are getting less additional credit than prime customers.

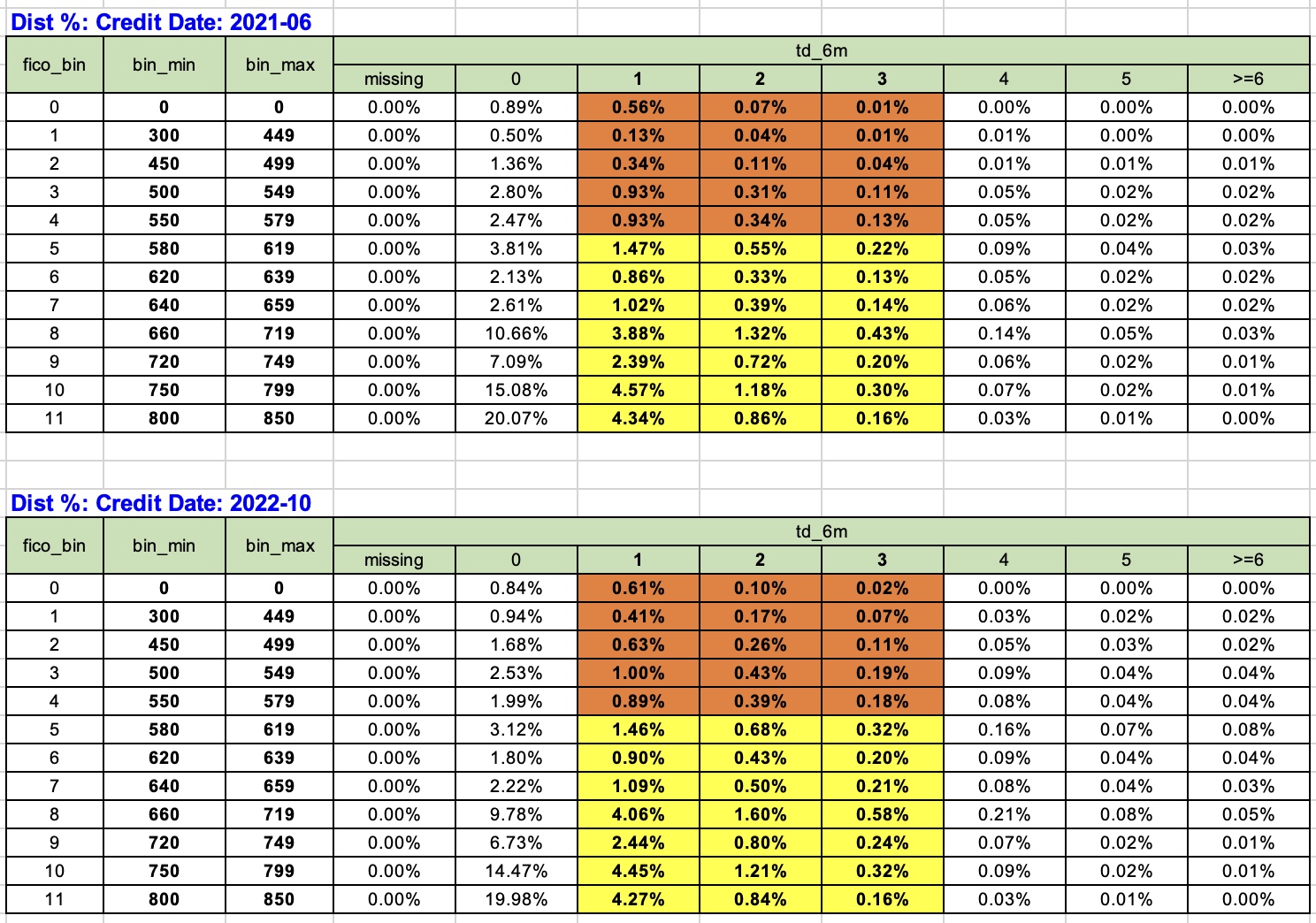

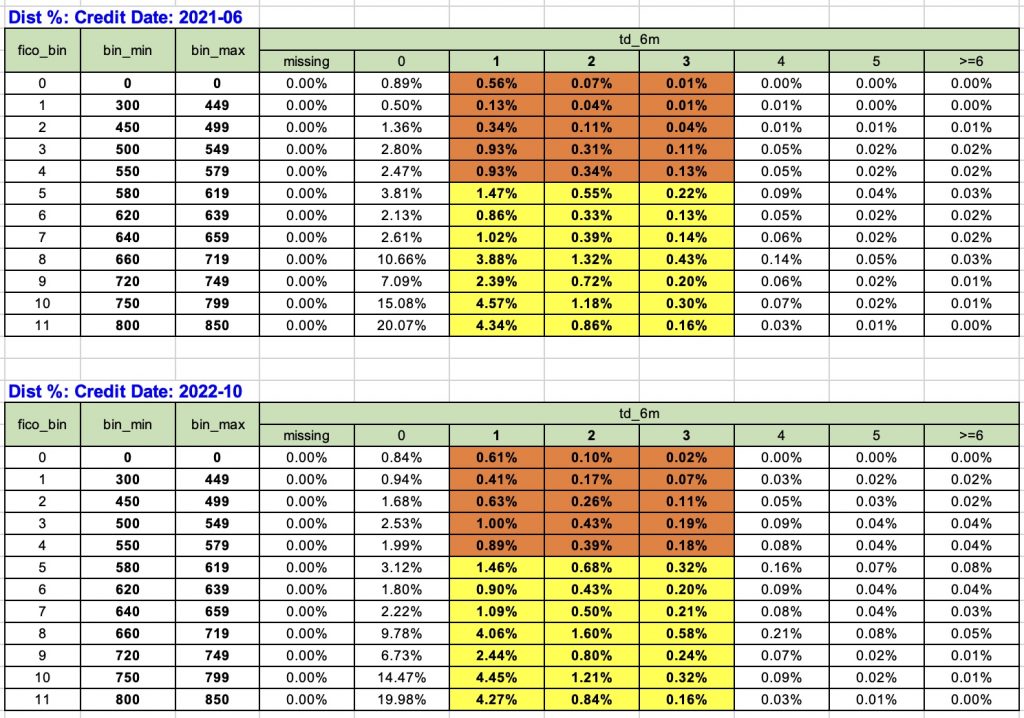

The two tables below represents two different time periods, the bookends of our observable period. The table on top is data from June 2021 stratified across credit score band. The table on the bottom of represents Oct 2022.

The cells colored in orange color represents those with a credit score lower than 580 and the yellow shaded cells represents those with credit score above 580. The columns, again reprints how many new trade lines was opened in the immediately past 6 months.

When we tally all of the orange shaded cells with 1 to 3 additional new credit trade lines it represented 4.06% of the total observable 180 million US population in June 2021 and 5.45% in October 2022, an increase of 35%

Similarly, when we look at the yellow shaded cells, we see a total of 25.46% of the total population back in June 2021 versus 26.75% in Oct 2022, an increase of 5%.

Our theory of subprime customers are getting less new trade line has been proven wrong. In fact, subprime consumers are getting more credit and becoming more actively involved in getting additional credit during this observed 18 months period.

Additional insights

On one hand, we are pleased to see that subprime consumers, or those below 580 credit score are actively receiving additional credit at a much faster pace than prime consumers, those with credit score 580 and above, but this also spells some troubling signs.

We theorized that that the quality of credit these subprime customers are getting is far less than those that already had high quality of credit within the prime population. That is to say, the subprime consumers will have to get 2 or 3 more credit trade lines to make ends meet than those with higher credit scores, namely higher credit card balance.

Saying it differently, sub prime consumers will have to work twice as hard as prime consumers to get the credit they need to pay for their daily needs during this inflationary period.

The subtlety in this data also tells us that the subprime consumers are fearful of getting their credit line reduced or cut completely similar to 2008 to 2010 when most of the credit card issuers have either shut off people’s credit cards or reduce their line of credit dramatically.

In part 2 of this analysis, we will test this trends by focusing on credit cards trade lines only.

Corrective action

Lenders will start seeing consumers with more trade lines than usual in the near and subprime population. Some lenders have rules that indicates a positive behavior when a client has multiple trade lines, however given the historical context, additional trade lines may not be a positive indicator of credit. We recommend lenders look at newly minted trade lines in the sub prime population and adjust their underwriting criteria to keep their future portfolio charge off numbers in line.

For those in the debt resolution, debt management, debt settlement industry, your clients credit history will get more complicated as you may have to settle or negotiate with even more creditor than before. You may start preparing and training your staff to look at the clients comprehensive credit history and ask to see if there are additional credit trade lines opened else where that aren’t reported to a particular credit bureau.

As always, we appreciate everyone reading our research findings and email us at info@maxdecision.com

Thank you!

MaxDecisions Research Team