MaxDecisions: US consumers credit is deteriorating at a faster pace but severity is decreasing

Credit Trend

MaxDecisions: US consumers credit is deteriorating at a faster pace but severity is decreasing

Research Overview

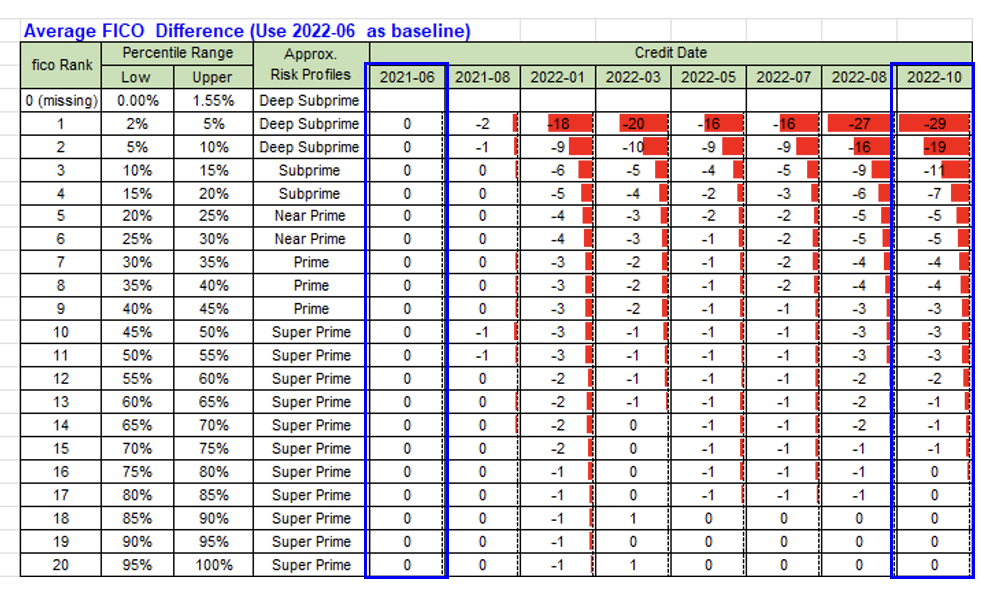

We’ve been tracking over 170 million US consumers across all credit spectrum from June 2021 to October 2022. Our thesis is simple, are we experiencing board deterioration of credit quality due to the rise in inflation, mass tech sector layoffs and global supply chain shortages? Our hypothesis is that we are experiencing a measurable drop in consumer credit quality across the board.

Since the publication of our first blog around significant drops of credit score across deep subprime to subprime to near subprime population, we are now looking at one of the most telling indicators of credit delinquency; number of days past due and other factors measuring consumer credit worthiness.

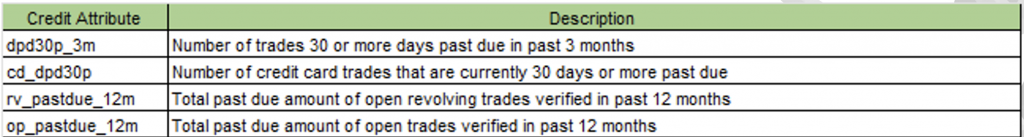

Term Definition:

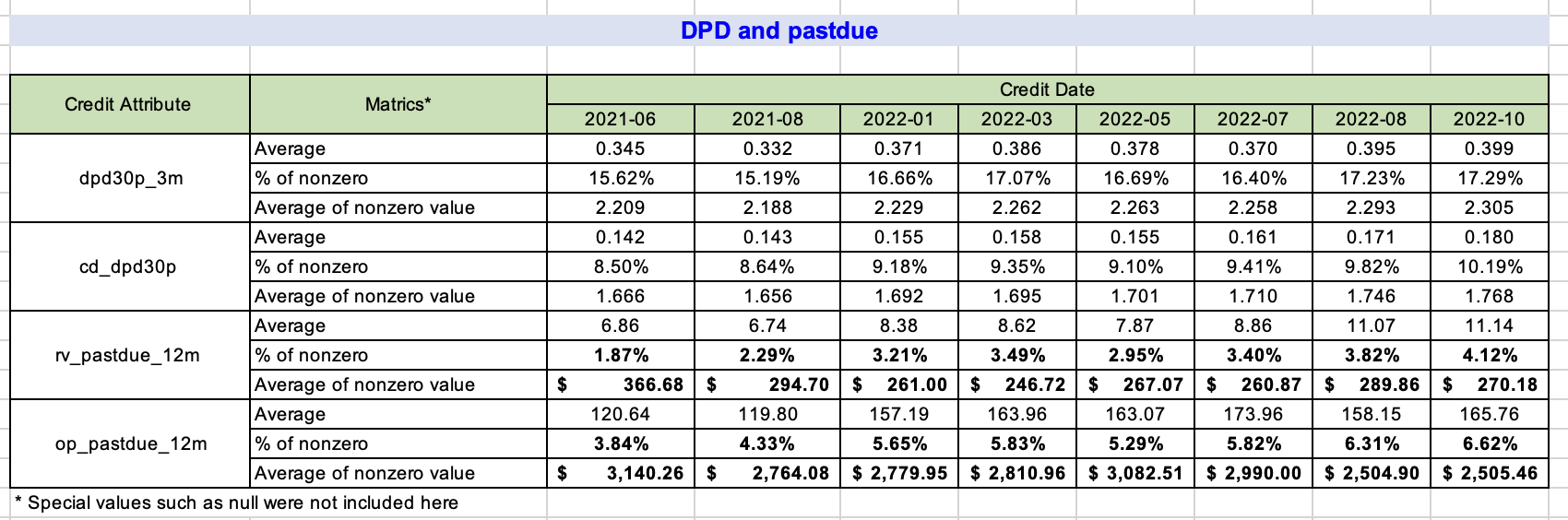

We used June 2021 as our baseline (1 or 100%) and measured all subsequent months against our baseline. We picked 4 different measurements to avoid any potential data and sampling issues.

Here are the 4 different measurements we used in our research:

- Number of trades 30 or more days past due in the past 3 months – (dpd30p_3m)

- Number of credit card trades that are currently 30 days or more past due – (cd_dpd30p)

- Total past due amount of open revolving trades verified in the past 12 month – (rv_pastdue_12m)

- Total past due amount of open trades verified in past 12 months – (op_pastdue_12m)

We picked these attributes believing that these variables represents the most current behavior of consumer credit and they are easily interpretable and understood by most risk professionals.

Inflation and Mass Layoffs

We are estimating about 300,000 tech workers were laid off from the latter half of 2022 to early 2023 when this blog is written. These workers make on average $97,000 a year as their annual salary. Although this population is correlated to the deep subprime or subprime population, there could be a trickle down affect of this massive unemployment event to the rest of the population. In other words, if higher income segment of the population stops spending, it will eventually hurt the bottom half of the US population.

Although unemployment leads to a cooled economy and therefore lower inflation, the on going inflationary pressure may not be solved by forced unemployment alone.

With credit card companies raising their APR from 16% to 19% to cover rise in interest rate and potential defaults, the subprime population is squeezed with this double whammy.

Numbers and Analysis

We sampled about 180 million US consumers over a year and a half from June 2021 to Oct 2022. We can clearly see a measurable and sizable increase in consumer credit deterioration across these 16 months of observable period.

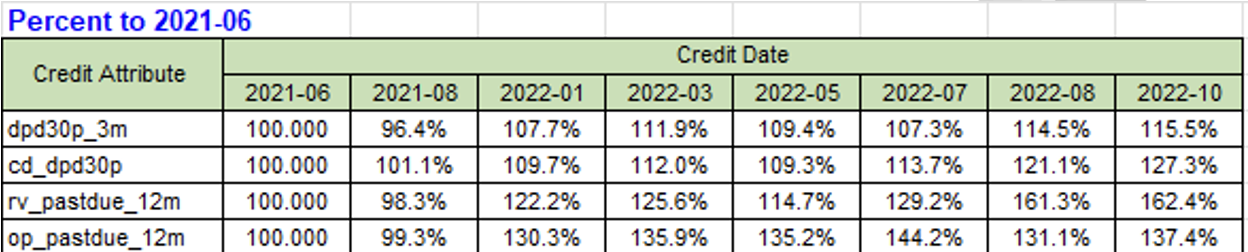

We first calculated the average values of these four attributes that measures consumer credit. Let’s take Total past due amount on revolving credit (e.g. Credit Cards) from June 2021 to Oct 2022, The average value is $6.859 and has increased to $11.140, a significant increase of 62%. These numbers include those that has 0 past due accounts as well as $0 past due amounts.

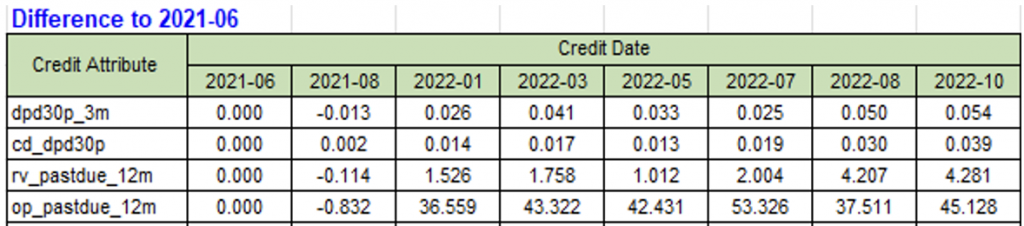

When we use June 2021’s numbers are a baseline, we see an increase of $45.128 dollars from June 2021 to Oct 2022. These numbers include those that has 0 past due accounts as well as $0 past due amounts.

When we look at the relative increases over these past 16 months of consumer credit performance, we see an increase of aforementioned 62% increase in revolving credit past due as well as open trades past due of 37.4%

Additional insights

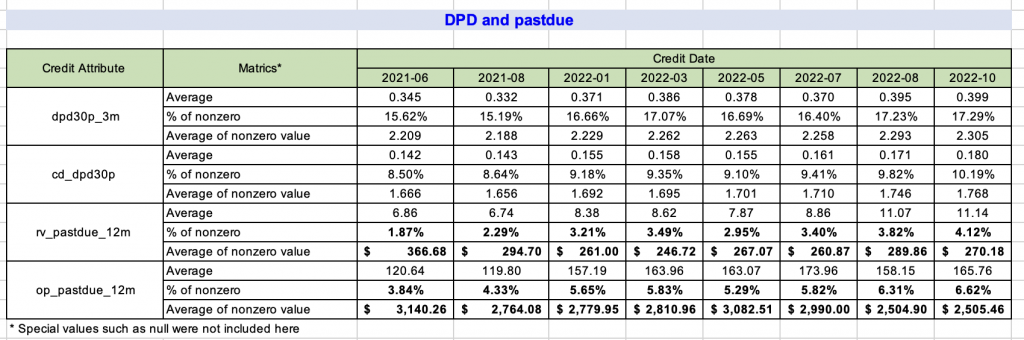

We further analyzed the population and isolated only those that have a past due amount and the result is confounding at first glance but here’s a simple explanation of why overall number of consumers went delinquent but the average dollar amount decreased.

The none-zero (or those that have a delinquent trade on their credit file) has increased dramatically from 1.87% to 4.12%, 220% increase in revolving credit card delinquency. In addition, the open trades non-zero count went from 3.84% to 6.62%, another 172% increase.

However when MaxDecisions looked at average dollar amount of past due, it went from $366.68 to $270.18 and $3140.25 to $2505.46. An decrease is observed, which doesn’t make sense! A decrease of 25% and 20% respectively.

The simple explanation is that many more Americans went into delinquent status but we are just in the first innings of severity (e.g. $) of delinquency!

Corrective action

Lenders will start seeing an decrease in qualified customers if they are only looking at the number of delinquent accounts. These underwriting criteria are powerful but one sided.

We recommend that lenders also look at the severity of these delinquencies since the amount of delinquencies is smaller relative to June of 2021.

However, we recommend that lenders should watch these newly minted customers, the severity of their delinquent accounts may rise over time to historical norms.

For the debt settlement industry, average debt load is decreasing but it doesn’t mean that this consumers can’t be helped. They might still have a story to tell. We recommend that you relax these criteria and include those that are delinquent but 20-30% lower in debt amount.

Thank you!

Team MaxDecisions ~ info@maxdecision.com