MaxDecisions: US deep-subprime consumers are seeking credit at its highest pace since global pandemic, prime consumers are pilling on even more debt – part 2

Credit Trend

Research Overview

The first three series of our blog have gained a tremendous amount of following. If you want to take a quick look at the previously published research, please click them below. As always we love to hear from the credit risk community on their take on what has happened in the past two years and what we will take place in then next two years as we emerge from global pandemic as well pass layoffs in the tech sector.

- https://www.maxdecision.com/blog/maxdecisions-us-consumer-credit-fico-score-drops-as-delinquency-rises-in-2023/

- https://www.maxdecision.com/blog/maxdecisions-us-consumers-credit-is-deteriorating-at-a-faster-pace-but-severity-is-decreasing/

- https://www.maxdecision.com/blog/maxdecisions-us-subprime-consumers-are-seeking-credit-at-a-historic-pace-due-to-uncontrolled-inflationary-pressure-part-1/

During the global pandemic, we started tracking 170 million US consumer’s credit files and payed out a series of theories. No one has predicted the inflationary pressure as one of the symptoms of global pandemic. This inflationary pressure resulted in global central banks to raise interest rates to calm consumer spending. The chain reaction of a rising interest rate is a calming consumer and corporate spending reality. Therefore to get a head of this slow down in consumer spending, various sectors are laying off employees, reforesting their revenues. This is especially felt in the tech sector, where half million tech sector employees have been laid off from mid 2022 to the first quarter of 2023.

Our research base population

We’ve been tracking over 170 million US consumers across all credit spectrum from June 2021 to October 2022. From our first series of research blogs, we observed a hastened growth in credit delinquency towards the end of 2022 and early 2023. We also observed that near prime, sub prime and deep subprime consumers are being impacted the most.

In our latest blog titled “US subprime consumer are seeking credit at a historic pace”, we examined the number of open trades or open line of credit opened in the past six months at each anchored vintage. We observed an increase of 30%+.

We also tracked 30 day delinquency, we saw 20% to 30% increase in delinquency for a large portion of the below prime population.

This is a worrisome trend for lenders and a potential wind fall for other companies in the consumer debt space. As inflationary pressure cooling slightly at the time of this blog. Consumer spending, unemployment rate are still at historic figures.

The talk of a recession has someone waned and the focus again is on the US Federal Reserves to set our borrowing interest rate even higher. As lay off continues in the tech sectors, we will focus on consumer spending across these 18 months of observable period and test a few theories.

We are now two month into 2023, consumer unsecured debt is reaching an all time high of $1 trillion US dollars. We will examine this thirst for credit and observe which segment of the US consumer population is shopping for credit and we have a few theories as to whether these consumers are getting the credit that they are looking. In other words, are credit card companies or lenders dishing out more money or tightening their credit underwriting ahead of pending economic slow down.

Term Definition

We used June 2021 as our baseline and measured all subsequent months against our baseline. We picked 2 measurements in terms of number of inquiries in the past six months per vintage to further explore US consumers demand fore credit.

We believe that there is a broad base of credit thirstiness across all US consumer population due to inflationary pressure. When consumer prices goes up and earned wage is not catching up at the same pace, consumers will need to take out more credit to pay for their day to day needs.

We also believe that across different credit spectrums, there are segmented impacts when it comes to the result of their credit seeking activities. Some of the results we are about to reveal might be in line with your expectations and some is surprising, even to us at MaxDecisions.

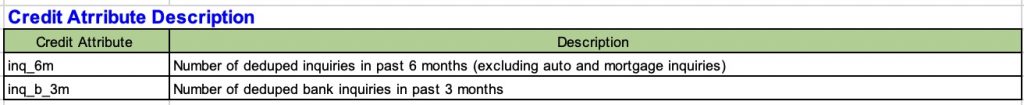

Here are the two measurements we used in our research:

- Number of deduped inquiries in the past 6 months (excluding auto and mortgage inquiries) – (inq_6m)

- Number of deduped bank inquiries in the past 3 months – (inq_b_3m)

These inquiries are de-duplicated to reduce noise. Some de-duplicate logic are done intra-day (if you are shopping around for loan and an credit aggregator may have pinged multiple lenders for an approval on your behalf within a minute, we will count that set of activities as one). Some other de-deduplicate logic are across multiple days (if you are shopping for a car during a long weekend are de-duplicated as one inquiry)

The first variables tracks the most recent six months per each vintage to see how many times a particular consumer has inquired about a new installment loan, credit card etc.

The second variables is there to track the past three months of inquiry behavior but only for credit inquiries initiated by a bank or a credit card company. Again, each vintage from June 2021 to Oct 2022 is tracked and we look back 3 months per each of these monthly vintages.

With these two variables, we believe we can paint an accurate picture of credit seeking behavior of these 170 million US consumers. Our theory is that there is broad based increase in credit seeking due to inflationary pressure. We also suspect that there might be disparate impact of credit seeking behavior between subprime and prime consumers.

Inflationary pressure and pending economic slow down

As of late February 2023, inflation numbers are still hovering around mid 6%. Even though it has fallen from its peak at 9% during the middle of 2022, the velocity of decrease is not fast enough to warrant a decease in interest rate from the Feds. These numbers at 6%+ is also a far cry from the “2%” or lower target set by Feds.

Close to another 100,000 tech sector laid offs happened in just January 2023. And Feb 2023 is on pace for another 100,000 lay offs. Over 260 tech companies in January has some type of lay off, a year over year record.

Close to 300,000 tech lay offs in the past 14 months and counting just in the tech sector alone.

The latest labor report suggests that at the end of February 2023, there’s still a tight labor market. Jobless claim fall by 3,000 to 192,000. Continuing claim dropped again to 1.654 million.

With little to no sign of declining inflation, economists and the marketing is now fearing a fresh round of rate increase. It was suggested that the Feds will increase the borrowing rate by another 25bps, however some economist are now predicting that Feds might increase this lending rate by as much as 50bps to further cool down the economy and therefore inflation.

At the time of the writing, CEO of JPMorgan Chase, Jamie Dimon suggests that the Feds are losing control over inflation and the tools at their disposal is not working as they suspected.

Credit seeking behavior

We sampled over 170 million US consumers over a year and a half from June 2021 to Oct 2022.

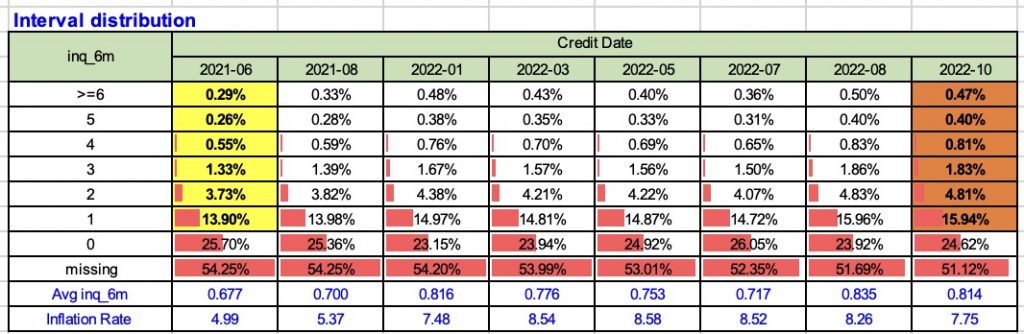

First, let’s take a look at the following table. Horizontal rows represent the number of inquiries made in the past six months. These values ranges from missing (never made an inquiry) to greater and equal to six inquiries.

Columns within this table below represents vintages. The first column represents June 2021 and the last column represents October 2022. The percentages in each column adds up to 100%.

Let’s take a look at those that made at least 1 injuries in the past six month. Back in June 2021, 13.90% of the population (roughly 23 million people) made 1 inquiry in the past six month. Fast forward to Oct 2022, last column, we see that 15.94% exhibited the same behavior (roughly 27 million people, a net increase of 6 million Americans seeking credit at least once) an increase of 14.6% across these 16 months of observable period.

If we look at those that made at least 2 inquiries in the past six months from June 2022 to July 2023, we see an increase of 29%.

For those that made 3 inquiries in the past six month, that increase becomes 38%. We see this pattern repeats itself as we move further up in the number of inquiries made in the past six months.

Where are these credit seeking population come from? Let’s take look at the “mission” or “0” row in the table above towards the bottom of the table.

We see that the population that has “missing” or “0” inquires dropped by 5%, represents 8,500,000 people joining the credit seeking crowd. Of course those that were already actively seeking credit are doubling up their effort to attempt to look for more credit.

If you look at the inflation number on the very bottom of the table above. Inflation percentages went from 4.99% to 7.75%. We believe that this credit seeking behavior is driven by high cost of consumer goods and services and a symptom of high flying inflationary pressure on the US economy as well as individual’s spending power.

Disparate Impact – Credit seeking for different reasons

As usual, we like to examine these behaviors under credit score bands to further analyze this credit seeking behavior. As the title of this section of our analysis suggests, we are looking at a bookend effect of this credit seeking behavior.

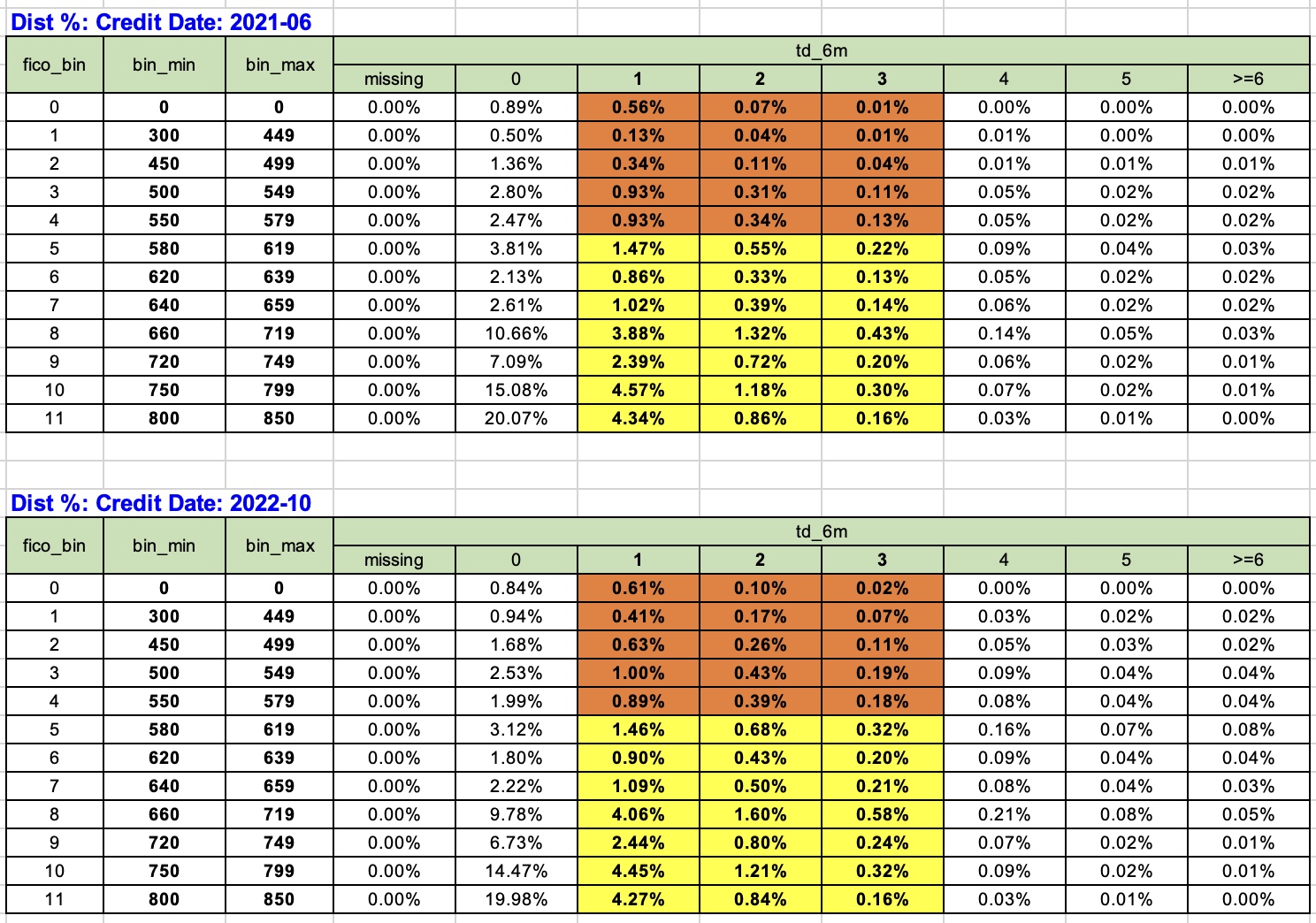

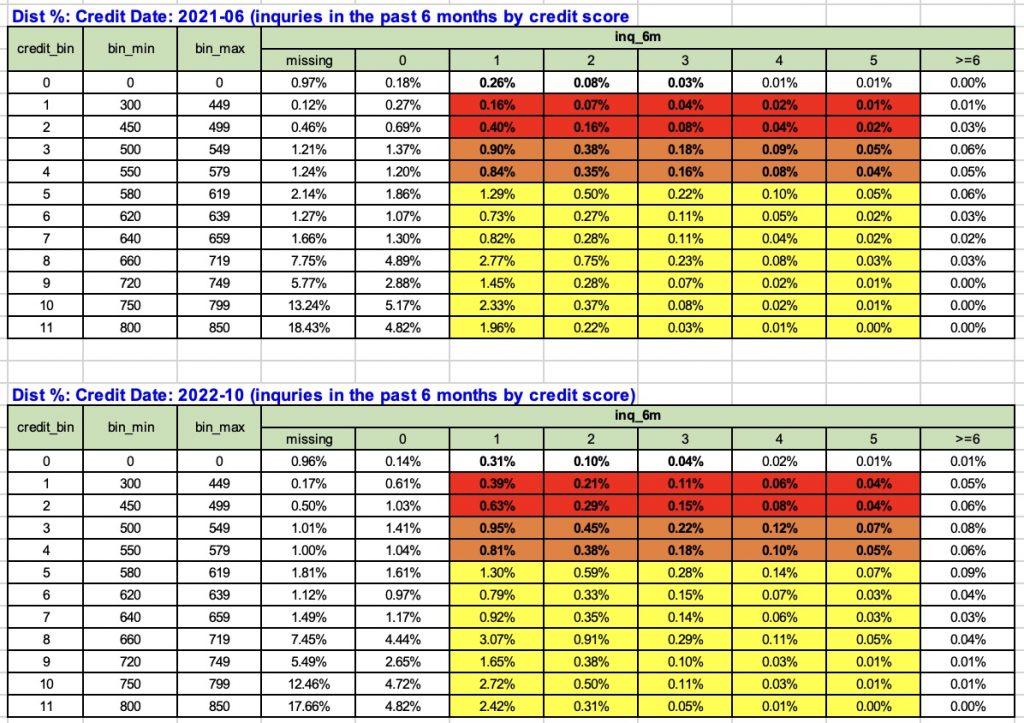

Let’s take a look at this table below. We stratified the the same data point, inquiries in the last six month across 20 point credit score bands.

The top table represents the starting vintage of our observable period, June 2021. The bottom table represents the end of our observable period, Oct 2022. We color coded deep subprime in red color, subprime in orange and the rest of the population in yellow. Cells with % in them adds up to 100%.

Let’s take a look at the column under inq_6m / 1. This column represents the section of the population with 1 inquiry in the past 6 months.

If we look at row with credit_bin 1 and 2 representing credit score 300 to 499, we see a corresponding percentage of 0.16% and 0.40% of 170 million US consumers.

If we look at the same cells on the bottom part of this table below, representing October 2022, we see 0.39% and 0.63%.

If we do a compare between these two vintages (June 2021 to Oct 2022) and in this deep subprime 300-499 score band, we see a 55% to 151% increase in credit seeking activity.

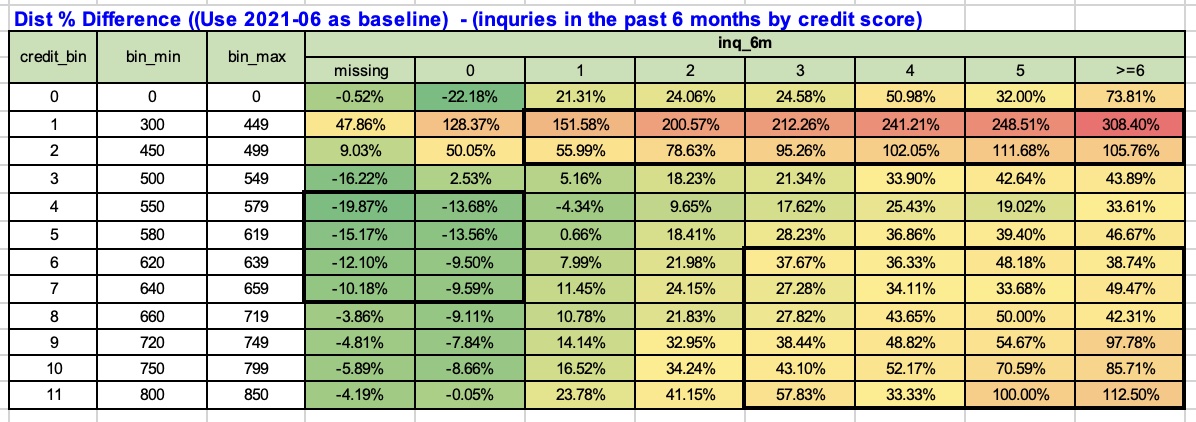

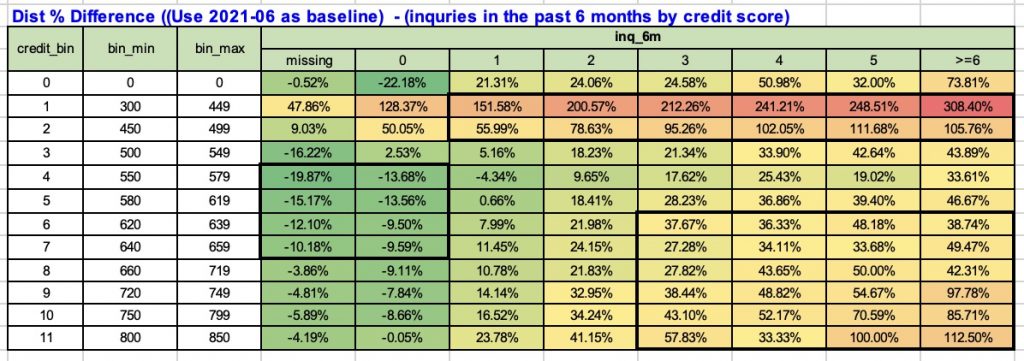

When we produce this delta table below between these two time periods, we see several behavior emerges.

First, the 300 to 499 credit band has experienced a tremendously growth in credit seeking behavior across all counts of inquiries in the past six month. This population represents 4%+ of the 170 million consumers, well over 7 million people.

There are several running theories as to why there’s a dramatic increase in their credit seeking behavior. One can suspect at this population needs access credit the most, and this population have to work extra hard to seek out credit. Most credit card companies won’t be able top provide credit for this population. This population of folks are probably using credit aggregation websites and apply to a bunch of lenders at the same time to maximize their chances. And thus leaving a trail of inquiries on their credit report.

The other notable behavior is the amount of people in the near-prime area with credit score between 550 to 660 have come out of their shells and starting to look for credit. We see a big decrease in those that have missing data or 0 inquiries between June 2021 and Oct 2022. These folks represents most of the US population are looking for additional credit.

We believe there’s a bit of a fear factor contributing to this behavior. During the last economic downturn of 2008 to 2010, many US consumer’s credit card limits were being cut by credit card companies. Unused credit cards are being forcibly cancelled all together.

We think that folks are apply for additional credit in case their credit will get taken away. In preparation of what’s about to happen, people are making a notable effort to get more credit under their belt. We can clearly observe this behavior in our data set.

One last thing to note is the behavior the prime and super prime population. In the table above, we highlighted this behavior on the lower right hand corner the table above.

There is a significant increase in credit seeking behavior of US consumers with good to great credit. We think this could be induced by pure inflationary pressure. Inflation impacts everyone across the credit spectrum. For those with good to great credit, it’s easier for them to amass line of credit or shop around to get access to additional credit. These folks won’t be sitting around to get slaughtered as well by credit card companies when the economic is slowing down as predicted by most economists.

Additional insights

Part 2 of this analysis features credit seeking behavior, or credit thirstiness. In a normal inflationary period, we might contribute what we see as mass hysteria. However, this observable period was in the latter half of the COVID 19 pandemic, people are still returning to work from mass layoffs from the service sector.

Whatever comes across towards the end of 2023, we suspect that people will be seeking credit potentially for different reasons. As interest rate inches higher, mortgages, auto lenders will have different ways to incentive consumers to spend money. As the rebalancing of the labor market (service vs. tech), we will see a whole new class of folks looking for credit to buy cars and homes.

We anticipate a great shift in credit seeking behavior of Generation Z consumers as well, representing 75 million US consumers.

Suggestions to lenders and debt industry

Lenders often have underwriting rules relating to desperation of applications looking for credit. The theory is that if there are excessive (everyone has a different definition of excessiveness) inquires on the applicant’s credit report, it’s probably a bad sign. They are either needing money for an unexpected life event or they are getting rejected by other lenders for reasons unknown or they are piling on credit and won’t be able to service them all when it’s all said and done.

Our recommendation is to balance this rule with their active usage of their existing line of credit. In our next blog, we will focus on utilization of line of credit. It will paint another picture

of our US consumer’s credit life. We will have brand new appreciation of why people are seeking credit at this historic pace.

For our friends in the debt management industry, there is no doubt that the American consumer are looking for more credit in these times. As their balances go up and maxing their credit limit, there will be more people looking for help to resolve their debt when the Feds finally achieve their goal of cooling our economy, in other words, massive layoffs and reduce consumer spending. If you are gearing up with your hiring plans, we suggest that you prepare for it now to capture millions of consumers seeking help in the coming months.

As always, we appreciate everyone reading our thoughts and write to us at info@maxdecision.com

Thank you!

MaxDecisions Research Team