MaxDecisions: COVID-19 Impact to Personal Credit & Mortgage – Part 2

COVID19

We released the much anticipated follow up to our initial publication on the impact of personal credit during COVID-19. We added another quarter of credit data ending in December 2020.

The story is far from over. Since Aug 2020, we followed 2 million American consumers and updated our analysis with incredible insights. You need to see it to believe it.

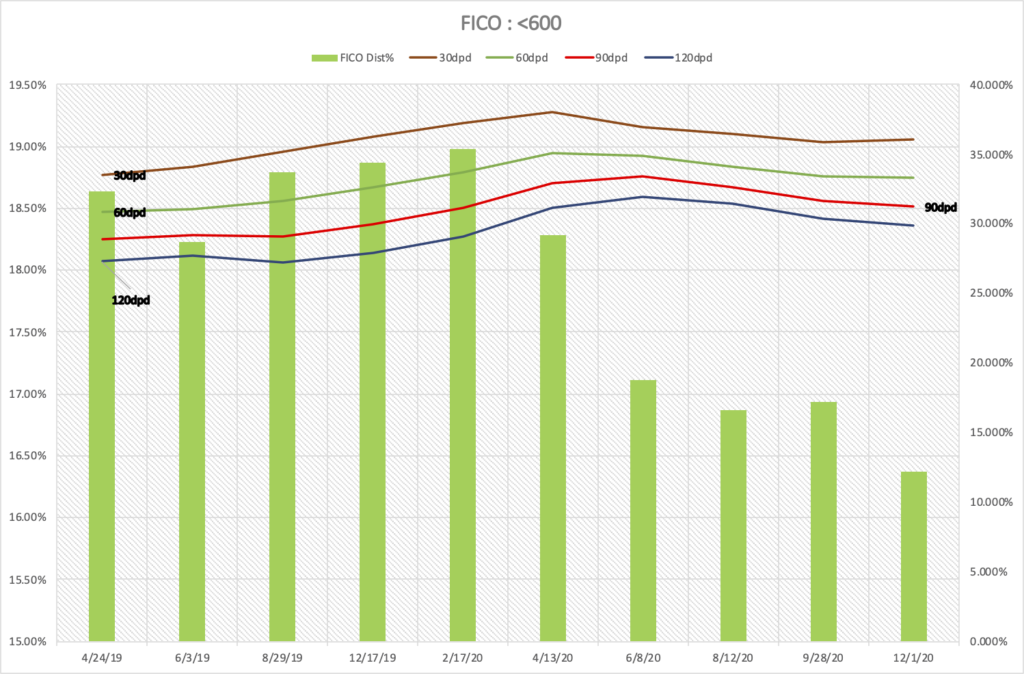

We analyzed across all credit bands, from super-prime to sub-prime and analyzed delinquency rates and spending behavior.

There were many surprises and contradictions. We hope our white paper can facilitate conversations about our citizens, potential social-economic issues and the impact of governmental stimulus programs.

Here are a few insights worth considering. 12% of the subprime population disappeared right after the pandemic exploded in the US, where did these consumers go? why are delinquency numbers going down for certain credit segments? Click here to download our updated analysis.

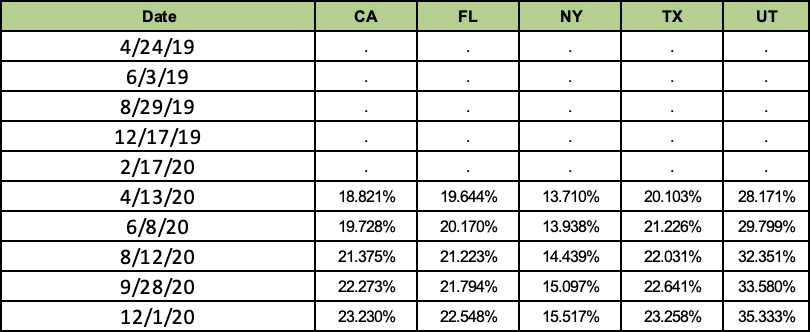

For our updated analysis, we added additional insight into how people shopped for mortgage during COVID19. Take a look at this table below. 1 in 3 people in Utah are looking to refinance their mortgage!

Download our free analysis: MaxDecisions: COVID-19 Impact to Personal Credit & Mortgage – Part 2.

Please send your comments to info@maxdecision.com